“Prop 208 — Initiative Petition Relating to Education Funding”

Here is Prop 208 as it will appear on our ballots:

PROPOSITION 208

PROPOSED BY INITIATIVE PETITION RELATING TO EDUCATION FUNDING.

A “yes” vote shall have the effect of imposing a 3.5% income tax surcharge, in addition to existing income tax rates, on taxable annual income over $250,000 for single persons or married persons filing separately, or $500,000 for married persons filing jointly or heads of households, to provide additional funds for public education; creating a new fund to direct the additional revenue to hiring and increasing salaries for teachers and other non-administrative support personnel, career training and higher education pathway programs for high school students, and the Arizona Teachers Academy; and increasing the dollar amount of scholarships available through the Arizona Teachers Academy.

A “no” vote shall have the effect of retaining existing law on income tax rates and funding for public education.

https://www.coconino.az.gov/DocumentCenter/View/37876/Ballot-Questions-List-11-3-2020-General

Arizonans should support Prop 208 for at least these reasons:

- Public education continues to be severely underfunded. During the Great Recession, the legislature stopped funding Prop 301, which mandated inflation increases in education. In 2018, after months of strikes by Arizona teachers and Red for Ed, under duress the State of Arizona finally agreed to increase funding by 7 or 8%. But this hardly moves the needle. K-12 public education funding in AZ is still $1.1 billion less than in 2008. Those lost funds have never been restored.

- Teacher shortage. Low pay has resulted in a teacher shortage. Elementary school teacher pay is $12,877 below the US median. Since August 31 2020, 754 teachers have quit Arizona K-12 schools, only 40% of which is due to COVID. There are currently over 3,000 vacant teaching positions, the highest in Arizona history. In many classrooms aides are doing the instruction, not certified teachers. 85% of rural school administrators surveyed say hiring new teachers is somewhat or very difficult (Morrison Institute).

- Inadequate support staff. The student-to-counselor ratio in Arizona is by far the worst in the nation, with 905 students per counselor. The American School Counselor Association recommends a 250-to-1 ratio.

- Growing public subsidies for private education. In the meantime, tax credits and vouchers have resulted in skyrocketing funding for Arizona’s private schools. Tax dollars to private schools will exceed $300 million in 2020 (AZ Dept. of Revenue). The General Fund, which makes up the bulk of public education funds, has lost 5.1 billion due to tax breaks since 1993 (Joint Legislative Budget Comm.).

- Lack of transparency in reporting by private schools is still a problem. “Relational financial conflicts” among private school owners continue to arise. Plus, some parents are misspending ESA voucher funds, apparently without repercussions. Vouchers favor students from well-off families in metro areas, increasing segregation and worsening inequities (Children’s Action Alliance).

Who is supporting Prop 208? Who is opposed?

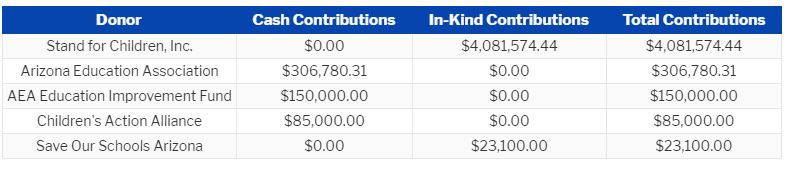

As of August 2020, the following were the top five donors who contributed to the committee in support of Prop 208:

As of August 2020, the committee in opposition to Prop 208 — self-styled as Arizonans for Great Schools and a Strong Economy– had these top five major donors:

Opponents claim that Invest in Ed is not grassroots but funded mainly by special interests. The “special interest” of the funders is public education. Stand for Children, Inc. is a non-profit education advocacy organization “focused on ensuring all students receive a high quality, relevant education” which is funded by Gates Foundation, The Walton Family Foundation, and others.

The “Whopping Tax Increase” Lie

The fact is that it only increases taxes on those making over $250,000 for an individual and $500,000 for a couple. A couple that makes $1,000,000 per year would pay an extra $8,500 in taxes, which is 0.85% of their taxable income. This is hardly a huge sacrifice for a couple making $1 million. For the rest of us, there will be NO tax increase.

In summary: The Republican-controlled legislature has fought the Arizona Education Association’s effort to restore public education funding to pre-recession levels, even though the economy has done well since 2009. Sadly, there is no reason to expect the legislature to restore public education funding or stop gutting the General Fund through tax breaks, ESAs and the use of public funds for private schools. The current trend increases social and educational inequality in Arizona, offers little hope for quality education for low income and minority students, and promises continued teacher flight from Arizona’s K-12 schools. Prop 208 is supported by the Arizona Education Association, Coconino Coalition for Children & Youth, and Expect More Arizona. A “Yes” vote on Prop 208 is recommended.