By Rob Tornoe with The Contributor:

“While the top 1 percent of taxpayers will bear the biggest burden, many other families, affluent and poor, will pay more as well,” wrote Wall Street Journal reporter Laura Saunders in a story about the effect the “fiscal cliff” agreement would have on taxpayers.

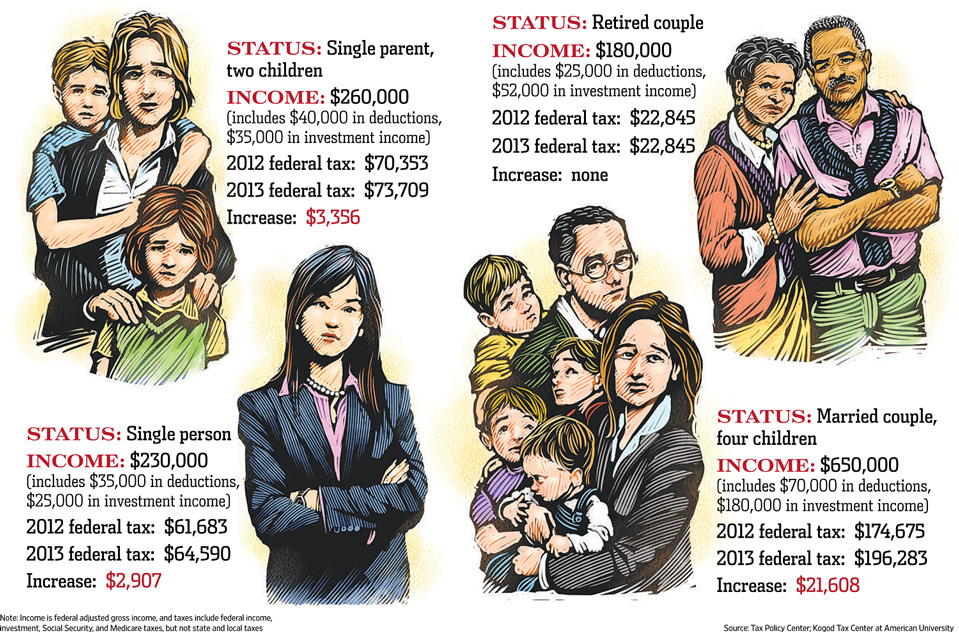

However, a graphic that accompanied the story might help explain the conservative mindset about cutting taxes for the rich. Despite writing about the effect tax inceases will have for the poor, apparently no one in their Wall Street Journal’s world makes under $100,000 a year.

I especially feel bad for the poor, single parent struggling to get by on the measly $260,000 she earns a year. After all, how’s she going to afford paying an extra $280 a month in taxes when she’s only bringing in $21,666 a month?

At least the retired couple that barely squeaks by with $180,000 a year of income in retirement won’t have to pay more taxes (although, wearing a sweater tied around your neck like Carlton Banks is a requirement).

I would remind the editors of the Wall Street Journal that the median income in the United States is right around $50,000 a year, and less than 5 percent of households in the country earn more than $166,000 a year.

Share this: