To judge by the screams coming from certain parts of the corporate world and the GOP side of Congressional aisles, Biden is demanding a “jobs-killing” confiscatory tax that will bring a screeching halt to our economy. Nothing could be further from the truth. Let’s call this out.

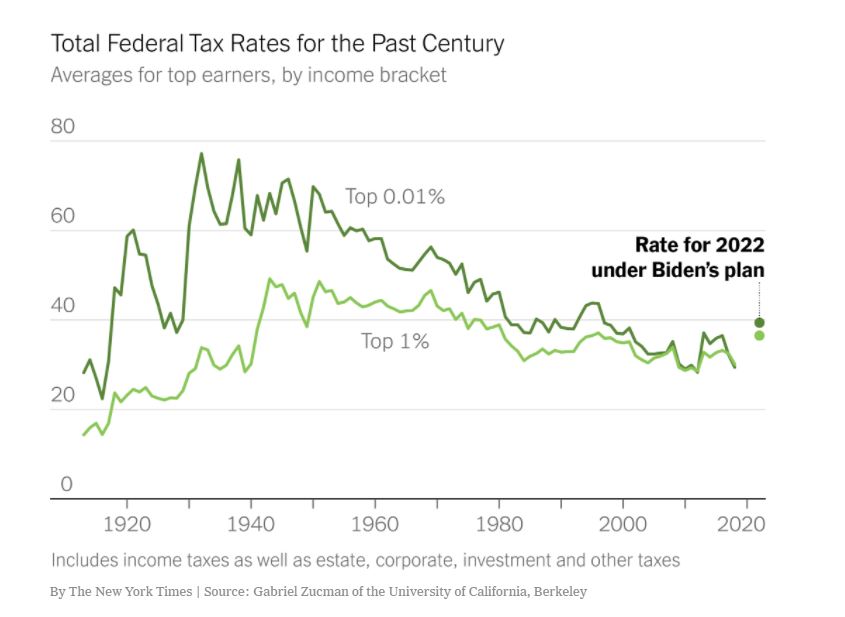

If all of Biden’s proposed tax increases passed — on the corporate tax, as well as on investment taxes and income taxes for top earners — the total federal tax rate on the wealthy would remain significantly lower than it was in the 1940s, ’50s and ’60s. It would also remain somewhat lower than during the mid-1990s, based on an analysis that Gabriel Zucman of the University of California, Berkeley, for the New York Times.

This chart shows the total federal rate for both the top 0.01 percent of earners (who currently make about $28 million a year on average) and the top 1 percent of earners (who make $1.4 million on average):

Economic history demonstrates that tax rates on the wealthy are not the main determinant of economic growth (and, if anything, higher taxes on the rich can sometimes lift growth). The main effect of Biden’s tax plan will be on the relative tax burden that wealthy — and we mean really wealthy — people pay. When they criticize the plan as unfair, archaic, and outrageous, they are really saying that they enjoy paying low tax rates.

Read more from this article: “A Modest Tax Proposal,” David Leonhardt, New York Times.

Share this: